Economy of Venezuela

| Economy of Venezuela | |

|---|---|

| Rank | 33rd |

| Currency | Bolívar fuerte (VEF) |

| Fiscal year | calendar |

| Trade organisations | WTO, OPEC, Unasur, MERCOSUR , ALBA |

| Statistics | |

| GDP | $350.100 billion (2009 est.)[1] |

| GDP growth | -2.9% (2009 est.)[2] |

| GDP per capita | $13,100 (2009 est.)[1] |

| GDP by sector | agriculture: 4%, industry: 41.9%, services: 54.1% (2005 est.) |

| Population below poverty line |

28% (2008 est.) [3] |

| Labour force | 12.67 million (2009 est. |

| Labour force by occupation |

agriculture: 13%, industry: 23%, services: 64% (1997 est.) |

| Unemployment | 10,9% (2009 est.)[1] |

| Main industries | petroleum, construction materials, food processing, iron ore mining, steel, aluminum; motor vehicle assembly, real state, tourism and ecotourism |

| Ease of Doing Business Rank | 177th[4] |

| External | |

| Exports | $51.99 billion (2009 est.)[1] |

| Export goods | petroleum, chemicals, agricultural products, basic manufactures |

| Main export partners | US 46.2%, Netherlands Antilles 13.5%, China 3.2% (2006) |

| Imports | $41.38 billion f.o.b. (2009 est.)[1] |

| Import goods | food, clothing, cars, technological items, raw materials, machinery and equipment, transport equipment, construction material |

| Main import partners | US 30.6%, Colombia 10.2%, Brazil 10.1%, Mexico 5.9%, China 4.9%, Panama 4.8% (2006) |

| Public finances | |

| Revenues | $39.63 billion |

| Expenses | $41.27 billion; including capital expenditures of $2.6 billion (2005 est.) |

| Main data source: CIA World Fact Book All values, unless otherwise stated, are in US dollars |

|

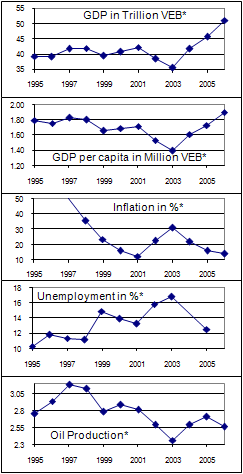

The economy of Venezuela is largely based on the petroleum sector, which accounts for roughly a third of the country´s GDP, around 80% of total exports, and more than half of the government operating revenues. Venezuela is the fifth largest member of OPEC by oil production. From the 1950s to the early 1980s the Venezuelan economy experienced a steady growth that attracted many immigrants. During the collapse of oil prices in the 1980s the economy contracted. With high oil prices and rising government expenditures, Venezuela's economy grew by 9% in 2007 but is expected to have shrunk by 2.9% in 2009 and further in 2010. Venezuela has one of the highest inflation rates in the world with 35% (2010,[5] according to Central Bank of Venezuela, the government received from 1998 to 2008 around 325 Billion USD through oil production and export,[6] and according to International Energy Agency, to June 2010 has production of 2.2 million of barrels per day, 800 thousand of whom go to the United States of America.[7]

In January, 2010, Hugo Chavez announced a fixed dual exchange rate system for the bolivar. The system offers a 2.6 bolivar per USD rate for imports of essential items such as food, medicine, and industrial machinery, and a 4.3 bolivar per USD rate for imports of other products, including cars and telephones.[1] CADIVI, the government body which administers currency exchange, will continue as the only administrator of the foreign currencies and executor of this devaluation.[8] Currently Venezuela imports almost all of its clothing, food, cars and electronic items.[9]

The International Energy Agency shows how Venezuela's oil production has fallen in the last years, producing only 2,300,000 barrels (370,000 m3) daily, down from 3.5 million in 1998, but with the recent currency devaluation the oil incomes will double its value in local currency, allowing the government to spend more.[10]

A recent International Monetary Fund (IMF) study qualified as "delayed and weak" the economic recovery of Venezuela in comparison with other countries of the region that had emerged from the world economic crisis "comparatively well" and were now recovering to a "strong rhythm". It forecast regional growth of an average of 4.0 percent this year and in 2011, while Venezuela´s economy will shrink by 2.6% in 2010.[11]

Contents |

History

1922 - 1964

When oil was discovered at the Maracaibo strike in 1922, Venezuela's dictator, Juan Vicente Gómez, allowed US oil companies to write Venezuela's petroleum law.[12] But oil history was made in 1943 when Standard Oil of New Jersey accepted a new agreement in Venezuela based on the 50-50 principle, "a landmark event."[13] Terms even more favorable to Venezuela were negotiated in 1945, after a coup brought to power a left-leaning government that included Juan Pablo Pérez Alfonzo.

From the 1950s to the early 1980s the Venezuelan economy was the strongest in South America. The continuous growth during that period attracted many immigrants.

In 1958 a new government again included Pérez Alfonso, who devised a plan for the international oil cartel that would become OPEC.[14] In 1973 Venezuela voted to nationalize its oil industry outright, effective 1 Jan. 1976, with Petróleos de Venezuela (PDVSA) taking over and presiding over a number of holding companies; in subsequent years, Venezuela built a vast refining and marketing system in the US and Europe.[15]

During Jimenez' dictatorship from 1952 to 1958, Venezuela enjoyed remarkably high GDP growth, so that in the late 1950s Venezuela's real GDP per capita almost reached West Germany's. However, from 1958/1959 onward, Romulo Betancourt (president from 1959 to 1964) inherited an enormous internal and external debt caused by rampant public spending during the dictatorship. Nevertheless, he managed to balance Venezuela's public budget and initiate a successful agrarian reform.[16]

1960s - 1990s

Buoyed by a strong oil sector in the 1960s and 1970s, Venezuela's governments were able to maintain social harmony by spending fairly large amounts on public programs including health care, education, transport, and food subsidies. "Great strides were made in literacy and welfare programs." [17]

Because of the oil wealth, Venezuelan workers "enjoyed the highest wages in Latin America."[18] This situation was reversed when oil prices collapsed during the 1980s. The economy contracted, and the number of people living in poverty rose from 36% in 1984 to 66% in 1995.[19] The country suffered a severe banking crisis (Venezuelan banking crisis of 1994).

As the economy contracted in the 1980s, inflation levels (consumer price inflation) fell, remaining between 6 and 12% from 1982 to 1986.[20] In the late 80s and early 90s inflation rose to around 30 - 40% annually, with a 1989 peak of 84%.[20] The mid-1990s saw annual rates of 50-60% (1993 to 1997) with an exceptional peak in 1996 at 99.88%.[20] Subsequently inflation has remained in a range of around 15% to 30%.[20]

By 1998, the economic crisis had grown even worse. Per capita GDP was at the same level as 1963, down a third from its 1978 peak; and the purchasing power of the average salary was a third of its 1978 level.[21]

1999 - present

Hugo Chávez was elected president in December 1998 and took office in February 1999. His economic policies have been more socialistic than those of his predecessors. In the first four years of the Chávez presidency, the economy contracted, at first because of low oil prices, then because of the turmoil caused by the 2002 coup attempt and the 2002-2003 business strike. Other factors in the decline were an exodus of capital from the country, and a sudden reluctance of foreign capitalists to invest there. Gross Domestic Product was 50.0 trillion bolivares in 1998. At the bottom of the recession, 2003, it was 42.4 trillion bolivares (in constant 1998 bolivares).[22] However, with a calmer political situation in 2004, GDP rebounded 50.1 trillion bolivares, and has risen strongly since, to 66.1 trillion bolivares in 2007 (both in constant 1998 bolivares). Particularly important in the recovery was the defeat of the oppositionist management at PdVSA after the 2002-2003 lockout/strike, which gave the government, for the first time, actual control of the state oil company and allowed the pursuit of a unified economic policy.[23]

In response to the low oil prices at the end of the 1990s, Chavez played a leading role within OPEC to reinvigorate that organisation and obtain members' adherence to lower production quotas designed to drive up the oil price. Venezuelan oil minister Alí Rodríguez Araque's announcement in 1999 that his country would respect OPEC production quotas marked "a historic turnaround from the nation's traditional pro-US oil policy." [24]

Rising petroleum prices in 2000 took some pressure off the budget and currency. However, with the president's economic cabinet attempting to reconcile a wide range of views, the country's economic reform program had largely stalled. Reforms that were undertaken included the reduction or abolition of education, healthcare and nutrition fees to millions of Venezuelans.

The government sought international assistance to finance reconstruction after massive flooding and landslides in December 1999 caused an estimated US$15 billion to $20 billion in damage.

The hardest hit sectors in the worst recession years, 2002–2003, were construction (-55.9%), petroleum (-26.5%), commerce (-23.6%) and manufacturing (-22.5%). The drop in the petroleum sector was caused by adherence to the OPEC quota established in 2002 and the virtual cessation of exports during the PdVSA-led Venezuelan general strike of 2002-2003. The non-petroleum sector of the economy contracted by 6.5% in 2002. The bolivar, which has been suffering from serious inflation and devaluation relative to international standards since the late 1980s,[25] continued to weaken. The inflation rate, as measured by consumer price index, was 12.3% in 2001 and 31.2% in 2002. On 23 January 2003, in an attempt to support the bolivar and bolster the government's declining level of international reserves, as well as to mitigate the adverse impact from the oil industry work stoppage on the financial system, the Ministry of Finance and the central bank suspended foreign exchange trading. On 6 February, the government created CADIVI, a currency control board charged with handling foreign exchange procedures. The board set the US dollar exchange rate at 1,596 bolivares to the dollar for purchases and 1,600 to the dollar for sales.

The Venezuelan economy shrank 5.8 percent in the first three months of 2010 compared to the same period last year[26] and now has the highest inflation rate in Latin America—30.5 percent.[26] President Hugo Chavez has expressed optimism that Venezuela will soon emerge from recession,[26] despite the International Monetary Fund forecasts showing that Venezuela will be the only country in the region to remain mired in recession this year.[27]

Sectors

Petroleum and other resources

Venezuela is a major producer of petroleum products, which remain the keystone of the Venezuelan economy.

A range of other natural resources, including iron ore, coal, bauxite, gold, nickel, and diamonds, are in various stages of development and production. In April 2000, Venezuela's President decreed a new mining law, and regulations were adopted to encourage greater private sector participation in mineral extraction.

Venezuela utilizes vast hydropower resources to supply power to the nation's industries. The national electricity law is designed to provide a legal framework and to encourage competition and new investment in the sector. After a 2-year delay, the government is proceeding with plans to privatize the various state-owned electricity systems under a different scheme than previously envisioned.

Manufacturing

Manufacturing contributed 17% of GDP in 2006. The manufacturing sector continues to increase dramatically in spite of private under-investment. Venezuela manufactures and exports steel, aluminium, transport equipment, textiles, apparel, beverages, and foodstuffs. It produces cement, tires, paper, fertilizer, and assembles cars both for domestic and export markets.

Agriculture

Agriculture in Venezuela accounts for approximately 3% of GDP, 10% of the labor force, and at least one-fourth of Venezuela's land area. Venezuela exports rice, corn, fish, tropical fruit, coffee, beef, and pork. The country is not self-sufficient in most areas of agriculture. Venezuela imports about two-thirds of its food needs. In 2002, U.S. firms exported $347 million worth of agricultural products, including wheat, corn, soybeans, soybean meal, cotton, animal fats, vegetable oils, and other items to make Venezuela one of the top two U.S. markets in South America. The United States supplies more than one-third of Venezuela's food imports.

Trade

Thanks to petroleum exports, Venezuela usually posts a trade surplus. In recent years, nontraditional (i.e., nonpetroleum) exports have been growing rapidly but still constitute only about one-fourth of total exports. The United States is Venezuela's leading trade partner. During 2002, the United States exported $4.4 billion in goods to Venezuela, making it the 25th-largest market for the U.S. Including petroleum products, Venezuela exported $15.1 billion in goods to the U.S., making it its 14th-largest source of goods. Venezuela opposes the proposed Free Trade Agreement of the Americas.

Since 1998 People's Republic of China-Venezuela relations have seen an increasing partnership between the government of the Venezuelan president Hugo Chávez and the People's Republic of China. Sino-Venezuelan trade was less than $500m per year before 1999, and reached $7.5bn in 2009, making China Venezuela's second-largest trade partner,[28] and Venezuela China's biggest investment destination in Latin America. Various bilateral deals have seen China invest billions in Venezuela, and Venezuela increase exports of oil and other resources to China.

Labor

Under Chávez, Venezuela has also instituted worker-run "co-management" initiatives in which workers' councils play a key role in the management of a plant or factory. In experimental co-managed enterprises, such as the state-owned Alcasa factory, workers develop budgets and elect both managers and departmental delegates who work together with company executives on technical issues related to production.[29]

Infrastructure

Venezuela has an extensive road system. The capital Caracas has a modern subway system over 31.6 mi (51 km) long. Maracaibo and Valencia (third city) has recently inaugurated a metro system. The Maracaibo (second city) metro system is still unfinished. Rail transport in Venezuela has been practically non-existent since the 1950s (with only one line operating), but the IAFE is currently working on several lines, hopefully connecting most of Venezuela via railway by 2020, which, if achieved, would lead to a significant improvement in the countries' transport infrastructure.

At the beginning of August 2008, Venezuelan president Hugo Chavez and his colleagues from Argentina and Brazil spoke about Latin American integration and Chavez threw an ambitious idea out: a train that would connect Venezuela's capital (Caracas) with Argentina's (Buenos Aires), and cities in between .[30]

The Chavez government has launched a National Railway Development Plan designed to create 15 railway lines across the country, with 8,500 miles (13,700 km) of track by 2030. The network is being built in cooperation with China Railways, which is also cooperating with Venezuela to create factories for tracks, railway cars and eventually locomotives.[31]

Statistics

Economy Data

| Year | Inflation rate (%) |

Year | Inflation rate (%) |

Year | Inflation rate (%) |

||

| 1980 | 21.4 | 1990 | 40.7 | 2000 | 16.2 | ||

| 1981 | 16.2 | 1991 | 34.2 | 2001 | 12.5 | ||

| 1982 | 9.6 | 1992 | 31.4 | 2002 | 22.4 | ||

| 1983 | 6.2 | 1993 | 38.1 | 2003 | 31.1 | ||

| 1984 | 12.2 | 1994 | 60.85 | 2004 | 21.7 | ||

| 1985 | 11.4 | 1995 | 59.9 | 2005 | 16.0 | ||

| 1986 | 11.5 | 1996 | 99.9 | 2006 | 13.7 | ||

| 1987 | 28.1 | 1997 | 50.0 | 2007 | 18.7 | ||

| 1988 | 29.5 | 1998 | 35.8 | 2008 | 30.4 | ||

| 1989 | 84.5 | 1999 | 23.6 | 2009 |

The Macroeconomic Stabilization Fund (FIEM) decreased from US$2.59 billion in January 2003 to US$700 million in October, but central bank-held international reserves actually increased from US$11.31 billion in January to US$19.67 billion in October 2003.

The economy recovered and grew by 16.8% in 2004. This growth occurred across a wide range of sectors - the oil industry directly provides only a small percentage of employment in the country. International reserves grew to US$27 billion (old data, probably circa 2004). Polling firm Datanalysis noted that real income in the poorest sectors of society grew by 33% in 2004.

From 2004 to the first half of 2006, non-petroleum On the black market the bolívar fell 28% in 2007 to Bs. 4,750 per US$,[32] and declined to around VEF 5.5 (Bs 5500) per US$ in early 2009.[33]

On 7 March 2007 the government announced that the Venezuelan bolívar would be redenominated at a ratio of 1 to 1000 at the beginning of 2008 and renamed the bolívar fuerte ("strong bolivar"), to ease accounting and transactions. This was carried out on 1 January 2008, at which time the exchange rate was 2.15 bolívar fuerte per US$.[34] The ISO 4217 code for the bolívar fuerte is "VEF".

Government spending as a percentage of GDP in Venezuela in 2007 was 30%, smaller than other capitalist mixed-economies such as France (49%) and Sweden (52%) .[35] According to official sources from the United Nations, the percentage of people below the national poverty line has decreased during the presidency of Hugo Chávez, from 48.1% in 2002 to 28% in 2008.[36][37]

With the 2007 rise in oil prices and rising government expenditures, Venezuela's economy grew by 9% in 2007. Oil prices fell starting in July 2008 resulting in a major loss of income.

Hit by a global recession, the economy contracted by 2% in the second quarter of 2009,[38] contracting a further 4.5% in the third quarter of 2009. Chavez's response has been that these standards mis-state economic fact and that the economy should be measured by socialistic standards.[39] For 17 November 2009 the Central Bank reported that private sector activity declined by 4.5% and that inflation was averaging 26.7%. Compounding such problems is a drought which the government says was caused by El Nino, resulting in rationing of water and electricity and a short supply of food.[40]

The year 2010 promises a Venezuela still in recession as Gross Domestic Product has fallen by 5.8% in the first quarter of 2010.[41] The Central Bank has stated that the recession is due largely "to restricted access to foreign currency for imports, lower internal demand and electricity rationing." The oil sector's performance is also particularly troubling, with oil GDP shrinking by 5%. More importantly the Central Bank hints at the root cause of the oil contraction: "the bank said it was due to falls in production, "operative problems", maintenance stoppages and the channeling of diesel to run thermal generators during a power crisis."[41] While the public sector of the economy has fallen 2.8%, the private sector has dropped off an astounding 6%.[41] Such economic figures confirm the fact that Venezuela will be the last South American nation to emerge from recession.[41]

Socioeconomic indicators

Like most Latin American countries, Venezuela has an unequal distribution of wealth. The rich tend to be very rich and the poor very poor. In 1970, the poorest fifth of the population had 3% of national income, while the wealthiest fifth had 54%.[42] For comparison the UK 1973 figures were 6.3% and 38.8%, and the US in 1972, 4.5% and 42.8%.[42]

The more recent income distribution data available is for distribution per capita, not per household. The two are not strictly comparable because poor households tend to have more members than rich households; thus, the per household data tends to show less inequality than the per capita data. The table below shows the available per capita data for recent years from the World bank.

|

Personal Income Distribution |

|||||||

|---|---|---|---|---|---|---|---|

|

Share of personal income (%) received by: |

|||||||

|

Year |

Poorest fifth |

2nd fifth |

3rd fifth |

4th fifth |

Wealthiest fifth |

Wealthiest 10% |

GINI index |

|

1987 |

4.7 |

9.2 |

14.0 |

21.5 |

50.6 |

34.2 |

|

|

1995 |

4.3 |

8.8 |

13.8 |

21.3 |

51.8 |

35.6 |

46.8 |

|

1996 |

3.7 |

8.4 |

13.6 |

21.2 |

53.1 |

37.0 |

48.8 |

|

2000 |

4.7 |

9.4 |

14.5 |

22.1 |

45.4 |

29.9 |

42 |

|

Note that personal (per capita) income distribution, given in this table, is not exactly comparable with household income distribution, given in the previous table, because poor households tend to have more members. Sources: |

|||||||

Poverty in Venezuela increased during the 1980s and 1990s but has decreased during the Chávez presidency, with the exception of the troubled years 2002 and 2003. The table below shows the percentage of people, and the percentage of households, whose income is below a poverty line which is equal to the price of a market basket of necessities such as food.[43] Note that as an income-based measure of poverty, this omits the effect of some other factors that may affect economic wellbeing, such as the availability of free health care and education.

|

Percentage of people and households with income below national poverty line |

|||||||||||||||

| Year | 1989 | · · · | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | |

| Households | – | · · · | 48.1 | 43.9 | 42.0 | 40.4 | 39.0 | 48.6 | 55.1 | 47.0 | 37.9 | 30.6 | 28.5 | ||

| People | 31.3 | · · · | 54.5 | 50.4 | 48.7 | 46.3 | 45.4 | 55.4 | 62.1 | 53.9 | 43.7 | 36.3 | 33.6 | ||

Sources:

World Bank, 1997 World Development Indicators, p 52;

Weisbrot et al., Poverty Rates in Venezuela (CEPR, 2006);

Venezuela, Instituto Nacional de Estadística, Venezuela. Medición de la pobreza, según hogares y personas, 2000-07 (./pobreza/LIhogares.asp), accessed May 2009.

Note: The Instituto Nacional de Estadística gives these poverty data twice yearly. For brevity we have included only the end of year data. For example, in 2007, household poverty in the first six months was 27.5% (not shown), and in the last six months, 28.5% (shown). The 1989 datum is from the World Bank and, as far as we know, is a whole year average.

| indicator | Historical averages (%)(2003–2007) |

|---|---|

| Real GDP growth | 7.6 |

| Real domestic demand growth | 14.4 |

| Inflation | 20.1 |

| Current-account balance (% of GDP) | 13.7 |

| FDI inflows (% of GDP) | 1.1 |

| Major exports | % of total | Major imports | % of total |

|---|---|---|---|

| Oil& gas | 90.4 | Raw materials&intermediate goods | 44.5 |

| Other | 9.6 | Consumer goods | 24.5 |

| Capital goods | 31.0 |

| Leading markets 2006 | % of total | Leading suppliers | % of total |

|---|---|---|---|

| United States | 53.5 | United States | 44.5 |

| Netherlands Antilles | 8.8 | Colombia | 9.6 |

| China | 3.7 | Brazil | 7.9 |

Miscellaneous data

Electricity – production by source:

fossil fuel: 25.46%

nuclear: 0%

other: 0% (1998)

Electricity Production 110.7 KWh (2007)

Electricity – consumption: 83.84 KWh (2006)

Electricity – exports: 0.542 kWh (2006 est.)

Electricity – imports: 0 kWh (2007)

Agriculture – products: maize, sorghum, sugar cane, rice, bananas, vegetables, coffee; beef, pork, milk, eggs; fish

Currency: 1 bolívar fuerte (Bs.F.) = 100 centimos (Currency code: VEF)

Exchange rates:

bolívares fuertes (Bs. F) per US$1: 2,15 (January 2008)

bolívares (Bs) per US$1: 2150 (January 2006), 1440 (September 2002), 652,33 (January 2000), 605,71 (1999), 547,55 (1998), 488,63 (1997), 417,33 (1996), 176,84 (1995)

See also

- Banco Central de Venezuela

- List of Venezuelan Companies

- List of Venezuelan Cooperatives

Sources

Government of Venezuela, Instituto Nacional de Estadística (National Institute of Statistics.) Wide range of statistics. Adding pobreza/menupobreza.asp to the URL gives a menu of poverty statistics.

United Nations, UNdata Explorer.

Mark Weisbrot and Luis Sandoval:

- The Venezuelan Economy in the Chávez Years, Center for Economic and Policy Research, 2007.

- Update: The Venezuelan Economy in the Chávez Years CEPR, 2008.

Mark Weisbrot, Luis Sandoval, and David Rosnick, Poverty

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 "Venezuela: Economy. CIA World Factbook. 19 August 2010. Retrieved 3 September 2010.

- ↑ "Venezuelan Economy Shrinks 2.9 Percent". Voice of America News. 31 December 2009. Retrieved 3 September 2010.

- ↑ Forero, Juan (19 April 2010). "Despite billions in U.S. aid, Colombia struggles to reduce poverty". The Washington Post. http://www.washingtonpost.com/wp-dyn/content/article/2010/04/18/AR2010041803090.html.

- ↑ "Doing Business in Venezuela 2010". World Bank. http://www.doingbusiness.org/ExploreEconomies/?economyid=201. Retrieved 20 August 2010.

- ↑ (Spanish)"Venezuela es el país de Latinoamérica que tiene la inflación más alta." Noticias 24. 13 May 2010. Retrieved 3 September 2010.

- ↑ (Spanish)"Ingresos Petroleros de Venezuela 1999-2008." Centro de Investigaciones Económicas. 21 June 2008. Retrieved 3 September 2010.

- ↑ "Crude Oil Supply Vs. OPEC Output Target:Venezuela." IEA Oil Market Report. 11 August 2010. Retrieved 3 September 2010.

- ↑ (Spanish)"Anuncia Hugo Chávez devaluación de moneda." El Universal. 8 January 2010. Retrieved 3 September 2010.

- ↑ (Spanish) Aguzzi, María. "Plan de sustituir importaciones ha quedado sólo en el anuncio." El Universal. 12 October 2009. Retrieved 3 September 2010.

- ↑ (Spanish) "Contribución petrolera se duplica por ajuste cambiario." El Universal. 11 January 2010. Retrieved 3 September 2010.

- ↑ (Spanish)"FMI: Venezuela único país cuya economía se contraerá este año." El Universal. 21 April 2010. Retrieved 3 September 2010.

- ↑ Yergin, Daniel. The Prize: The Epic Quest for Oil, Money, and Power. New York:Simon and Schuster. 1990. pp 233-36; 432

- ↑ Yergin 1990, p 435

- ↑ Yergin 1990, pp 510-13

- ↑ Yergin 1990, p 767

- ↑ Alexander, Robert. "Nature and Progress of Agrarian Reform in Latin America." The Journal of Economic History. Vol. 23, No. 4 (Dec., 1963), pp 559-573.

- ↑ McCaughan, Michael. The Battle of Venezuela. New York: Seven Stories Press. 2005. p 63.

- ↑ McCaughan, Michael. The Battle of Venezuela. London: Latin America Bureau. 2004. p 31.

- ↑ McCaughan 2004, p 32.

- ↑ 20.0 20.1 20.2 20.3 "Venezuela Inflation rate (consumer prices)". Indexmundi. 2010. Retrieved 16 August 2010.

- ↑ Kelly, Janet, and Palma, Pedro (2006), "The Syndrome of Economic Decline and the Quest for Change", in McCoy, Jennifer and Myers, David (eds, 2006), The Unraveling of Representative Democracy in Venezuela, Johns Hopkins University Press. p207

- ↑ United Nations data, National accounts estimates of main aggregates.

- ↑ Weisbrot and Sandoval, 2008. Sections: 'Executive Summary,' and 'Social Spending, Poverty, and Employment.'

- ↑ McCaughan 2004, p 73.

- ↑ UN data site >> World Bank estimates >> GDP deflator, national currency.

- ↑ 26.0 26.1 26.2 Toothaker, Christopher. "Chavez: Venezuela's economy soon to recover." Bloomberg Businessweek. 8 August 2010. Retrieved 3 September 2010.

- ↑ Cancel, Daniel. "Chavez Says Venezuela's Economy Is `Already Recovering' Amid Recession." Bloomberg. 8 August 2010. Retrieved 3 September 2010.

- ↑ Suggett, James. "Latest Venezuela-China Deals: Orinoco Agriculture, Civil Aviation, Steel, and $5 Billion Credit Line." Venezuelanalysis.com. 3 August 2010. Retrieved 3 September 2010.

- ↑ Bruce, Iain. "Chavez calls for democracy at work." BBC News. 17 August 2005. Retrieved 22 September 2006.

- ↑ http://www.treehugger.com/files/2008/09/train-to-cross-south-america-southern-train-venezuela-argentina.php

- ↑ Sperling, Erik. "Venezuela Inaugurates New Line for Extensive Rail System Project." Venezuelanalysis.com. 24 March 2009. Retrieved 3 September 2010.

- ↑ Romero, Simon. "Venezuela to Give Currency New Name and Numbers." New York Times. 18 March 2007. Retrieved 3 September 2010.

- ↑ Molano, Walter. "Venezuela is Priced for Failure." Latin American Herald Tribune. 2009. Retrieved 3 September 2010.

- ↑ Ellsworth, Brian. "Venezuela cuts three zeros off bolivar currency." Reuters. 1 January 2008. Retrieved 3 September 2010.

- ↑ Weisbrot, Mark, and Sandoval, Luis.The Venezuelan Economy in the Chávez Years.Center for Economic and Policy Research.July 2007.

- ↑ Forero, Juan. "Despite billions in U.S. aid, Colombia struggles to reduce poverty." Washington Post. 19 April 2010. Retrieved 3 September 2010.

- ↑ (Spanish) "Situación de la pobreza en la región." Panorama social de América Latina. 2007. Retrieved 4 September 2010.

- ↑ Daniel, Frank. "Venezuela economy shrinks for first time in 5 years." Reuters. 20 August 2009. Retrieved 3 September 2010.

- ↑ Daniel, Frank. "Chavez says Venezuela in recession, by US yardstick." Reuters. 22 November 2009. Retrieved 3 September 2010.

- ↑ Márquez, Humberto. "El Niño Dries Up Water, Power, Food Supply." IPS News. 23 October 2009. Retrieved 3 September 2010.

- ↑ 41.0 41.1 41.2 41.3 Cawthorne, Andrew."Venezuela recession drags, GDP falls 5.8 pct Q1". Reuters. 25 May 2010. Retrieved 13 August 2010

- ↑ 42.0 42.1 World Bank. "Table 24." World Development Report. 1980. pp 156–157.

- ↑ "Ficha Técnicas de Línea de Pobreza por Ingreso." Estadísticas Sociales y Ambientales. El Instituto Nacional de Estadísticas. Retrieved 4 September 2010. The Instituto Nacional de Estadística describes their method for compiling these statistics.

- ↑ 44.0 44.1 44.2 "Factsheet". http://www.economist.com/countries/Venezuela/profile.cfm?folder=Profile-FactSheet. Retrieved 17 February 2009.

External links

- Wilpert, Gregory. Venezeula's Alternative to Neo-Liberalism IslamOnline.net, retrieved on 19-03-2009.

- Venezuela Energy Profile from the Energy Information Administration

- Venezuela to Give Currency New Name and Numbers

- Banco Central de Venezuela

- Venezuela's Economy During the Chavez Years

- Venezuela Nationalizes Gas Plant and Steel Companies, Pledges Worker Control by James Suggett, 22 May 2009

- Update on the Venezuelan Economy - Center for Economic and Policy Research report, September 2010

|

|||||||

|

|||||||||||||

|

|||||||||||